PRESIDENT’S LETTER

What’s Really Important in Our Business

Nick Brown, Merlex

After you’ve worked in the stucco industry a while, you begin to notice changes. The biggest thing I’ve noticed is the change in people and the spirit they bring to work. No one shows this better than Bob Anderson, who retired this month after a long career supplying stucco manufacturers with sand.

After you’ve worked in the stucco industry a while, you begin to notice changes. The biggest thing I’ve noticed is the change in people and the spirit they bring to work. No one shows this better than Bob Anderson, who retired this month after a long career supplying stucco manufacturers with sand.

Bob started in the sand business in 1959 by joining Ottawa Silica (Crystal Silica) in Oceanside, CA. When Crystal Silica ceased operations in 1991, Bob joined P.W. Gillibrand Co., Inc. of Simi Valley. When he came to see you, it was with a warmth and support that told you he really was there to do whatever he could to help your business. He told you the truth, unvarnished, but without any negativity toward his competition or anyone else. And when the inevitable problem popped up, he was all over it, helping to identify the root cause, get the plant back up and running, and make sure it never happened again. And pricing was never a main topic of conversation.

Guys like Bob Anderson are in short supply in our industry these days. Today, many salespeople seem to focus on price first and the warm handshake and support last. Bob was successful, and I believe our industry has been successful, because of a focus on building real relationships between people and businesses that we can depend on to help everyone get through the tough times. I think that with Bob’s retirement, it is an opportunity to reflect on what’s really important in our business, our relationships, and what our industry should look like when we retire. Let’s hope it’s a tightly knit industry of businesses that deal honestly with one another, support the industry, and add value like Bob Anderson did for over 50 years. Congratulations, Bob.

I would also like to take this opportunity to thank our outgoing SMA President, Todd Martin (Omega Products International) for his service last year and in years prior. It is largely because of his leadership that SMA is in good financial standing, finding new ways to spread the stucco message, including the DVDs, website, AIA on-line course, interesting meetings, and this e-newsletter. Thanks go also to last year’s board members Ted Jones (Parex), Ben Garcia (Expo), Ed Gorter (California Stucco), Sherry Davis (Carmeuse), and Mike Duarte (P.T. Hutchins).

Feature Articles

Hopeful Signs for California Builders

Christopher Thornberg, PhD, Principal, Beacon Economics

The recent swoon in home sales that hit California and the rest of the nation in July caused the markets to tumble and fears among builders to climb. Why this is the case remains a bit of a mystery to us, as this was one of the least surprising surprises in the news lately.

After real estate bubbles pop, there is traditionally a fairly lengthy period of time (2 to 3 years) when the market sits on the bottom, with weak sales and a slow pace of building before it starts to move forward again. This is understandable—there is a large decline in available home equity that could be used for trading up to a nicer property, the market is typically over-supplied with units built during the boom, fewer people are moving for jobs in a weak labor market and all in all so many people bought homes during the bubble that many families are simply content to enjoy for a few years before they start thinking about upgrading yet again. In a sense, baseline demand needs time to recharge.

Despite these formidable hurdles, the administration pursued numerous quixotic policies that seemed to be designed to try and reignite the market far before its time. Tax credit programs, quantitative easing, a rapid pace of FHA lending, and those programs designed to slow the pace of foreclosures all contributed to a small burst in market activity early in the year. Builders began to buy land back they had sold just a year or more ago at huge discounts. But when these programs had run their course, the false demand faded away and the market logically sagged back to the floor it will continue to sit at for some time yet. Builder confidence and residential building permits in the state fell with the pace of sales.

Yet other data sources say that builders should actually be growing more, rather than less confident. While the many bubble deniers had all sorts of kooky justifications for the massive increase in prices here in California the one thing they did get right was the relative lack of supply. The state has not built enough housing to meet population growth for well over a decade. Indeed in the midst of the boom the pace of sales was only slightly greater than the need for housing. The net result was that California had a severe over-crowding problem.

What this means is that builders in the state are more likely to see rising demand for their products than in other bubble states such as Arizona, Florida or Nevada. Indeed this has recently come to light in data from another source—in rental vacancies. The major markets in the state have seen substantial declines in rental vacancies from the not-very-high peaks hit last year. Los Angeles, for example, has seen vacancies drop from 7.3% to 6.6%. And no, this isn’t foreclosed owners moving into rental housing—as the number of units for sale in the state has remained relative steady.

While this is good news—builders still need to pay attention to what they build. In the midst of the bubble construction was focusing on higher end units in outlying areas. The major source of population growth in the state is immigration from other countries, many who are low skilled workers from Latin America. This mismatch between supply and demand has lead to some quirky results. For example, between 2000 and 2008 homeownership rates in the rest of the US rose rapidly. In California it was flat, and in some places even fell. This implies that the need for housing will not be in those finished lots in suburban So-Cal, but infill development of entry-level homes near transportation hubs.

The margins won’t be as nice—but at least revenues will get flowing again, and some of those many workers who found themselves out of a construction job in 2007 may actually find themselves earning a paycheck yet again.

[Former] Governor Schwarzenegger Announced First-in-the-Nation Statewide Green Building Standards Code

Continuing California’s efforts to fight climate change and protect the environment, (former) Governor Arnold Schwarzenegger announced the California Building Standards Commission unanimously adopted the first-in-the-nation mandatory Green Building Standards Code (CALGREEN) requiring all new buildings in the state to be more energy efficient and environmentally responsible. Taking effect on January 1, 2011, these comprehensive regulations will achieve major reductions in greenhouse gas emissions, energy consumption and water use to create a greener California.

“With this first-in-the nation mandatory green building standards code, California continues to pave the way in energy efficiency and environmental protection. Today’s action lays the foundation for the move to greener buildings constructed with environmentally advanced building practices that decrease waste, reduce energy use and conserve resources,” said Governor Schwarzenegger. “The code will help us meet our goals of curbing global warming and achieving 33 percent renewable energy by 2020 and promotes the development of more sustainable communities by reducing greenhouse gas emissions and improving energy efficiency in every new home, office building or public structure.”

CALGREEN will require that every new building constructed in California reduce water consumption by 20 percent, divert 50 percent of construction waste from landfills and install low pollutant-emitting materials. It also requires separate water meters for nonresidential buildings’ indoor and outdoor water use, with a requirement for moisture-sensing irrigation systems for larger landscape projects and mandatory inspections of energy systems (e.g., heat furnace, air conditioner and mechanical equipment) for nonresidential buildings over 10,000 square feet to ensure that all are working at their maximum capacity and according to their design efficiencies. The California Air Resources Board estimates that the mandatory provisions will reduce greenhouse gas emissions (CO2 equivalent) by 3 million metric tons equivalent in 2020.

Upon passing state building inspection, California’s property owners will have the ability to label their facilities as CALGREEN compliant without using additional costly third-party certification programs.

In 2007, Governor Schwarzenegger directed the California Building Standards Commission (BSC) to work with specified state agencies on the adoption of green building standards for residential, commercial and public building construction for the 2010 code adoption process.

“We are committed to seeing the Governor’s vision for developing a green framework in California become a reality,” said California State and Consumer Services Agency Acting Secretary Tom Sheehy. “This new standard will set a nationwide example of how to incorporate building smart, resource-efficient and environmentally-responsible buildings into the everyday fabric of our state.”

The mandatory code provisions will now become the baseline of regulated green construction practices in the country’s most populous state. The BSC, which developed this initial Green Building Standards Code with extensive discussions with environmentalists, architects, builders, local officials and others, will continue to improve this new code with those interested parties.

In addition to the mandatory regulations, CALGREEN also includes more stringent voluntary provisions to encourage local communities to take further action to green their buildings to reduce greenhouse gas emissions, improve energy efficiency and conserve our natural resources.

Like California’s existing building code provisions that regulate all construction projects throughout the state, the mandatory CALGREEN provisions will be inspected and verified by local and state building departments. CALGREEN will use the long-standing, successful enforcement infrastructure that the state has established to enforce its health, safety, fire, energy and structural building codes. Many of the mandatory provisions in the code are already part of the statewide building code, making verification of CALGREEN an easy transition for local building inspectors.

Member News – Bob Anderson Retires

After 59 years in the Sales profession, Bob Anderson of P.W. Gillibrand Co, Inc. retired on December 31, 2010.

Following high school and a stint in the U.S. Navy, Bob attended L.A. City College and the University of Southern California, graduating in 1951 with a degree in Business Economics. Shortly after obtaining his degree, he began his sales career with the Shell Oil Company. In 1953 Bob moved to U.S. Limestone Products Co. (now Chemical Lime) and then entered the industrial sand business in 1959 by joining Ottowa Silica (Crystal Silica) in Oceanside, CA. When Crystal Silica ceased operations in 1991, Bob joined P.W. Gillibrand Co., Inc.

Bob has been a good friend to the stucco industry throughout his career, and we are grateful for the contributions he has made to the success of our company. Please offer Bob, and his wife Patty, your best wishes for a wonderful retirement.

It’s That Time of Year Again for Efflorescence in California

Kenneth Parks, CEMEX Technical Services Manager

The California rainy season has come early this year. One of the phenomenons that begin to appear more frequently in the fall for California homeowners and Contractors is efflorescence. Efflorescence appears in concrete construction as well as stucco/masonry construction. What exactly is efflorescence? A dictionary definition (Merriam Webster) of efflorescence is “The formation of a powdery surface on crystals, as a hydrate is converted to anhydrous form by losing loosely bound water of crystallization to the atmosphere.” To put it into layman’s terms, efflorescence is the product of water moving through a wall and bringing the natural salts to the surface. When the water and natural salts arrive at the surface, the water evaporates and the salts combine with the carbon dioxide in the air to form the white powdery substance on the surface of the wall. In the plastering industry we are referring to the crystalline deposit, usually white, that may develop on the surface of integrally colored exterior Portland cement plaster finishes or the calcium or alkaline salt which forms as a blotchy, powdery or crystalline deposit on the surface of Portland cement plaster finishes.

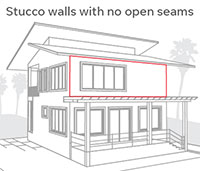

Efflorescence occurs as a result of a combination of factors. Those factors include soluble salts, physical forces applied to the walls, moisture that is present, and an opening through which the salts may migrate to the surface. Where do these salts come from? The soluble salts are present in the earthen building materials, water, and may leach from the soils and migrate into the building substrate. Quantities of water-soluble salts as small as a few tenths of one percent are sufficient to cause efflorescence. Physical forces applied to the wall include wind, capillary action, hydrostatic pressure and osmotic pressure. The moisture present for efflorescence to occur may come from many sources. Those sources include but are not limited to the mixing water, cleaning water, precipitation, groundwater, condensation or even from a landscaping sprinkler system. Lastly, there must be a pathway for salts to migrate out of the wall. These pathways could be from hairline cracks, shrinkage cracks, settling cracks, cracks from vibrations or even microscopic openings in the material itself. If one of the above factors is not present, efflorescence should not occur. What type of controls should we put in place to try to minimize the chance of efflorescence occurring?

There are many things that we can control to help minimize the chance of efflorescence occurring. The things we need to consider are:

- Properly graded aggregates

- Clean aggregates

- Low water/cementitious ratio mixes

- Proper curing techniques

- Good workmanship techniques

- Provision for good drainage away from the structure

Everyone must remember that there is one thing we cannot control; that is Mother Nature. Since we cannot control the weather, we must take prudent actions to minimize the contribution of the above listed factors. If efflorescence does occur, what should one do?

There are many options on how to deal with efflorescence:

- Dry brush the surface then flush the surface with clean water.

- Clean the surface with a vinegar and water solution (1 part vinegar to 5 parts water) and try a test patch first to check for possible discoloration of colored wall.

- Saturate the wall with water, then wash with a diluted acid solution (2-5 parts hydrochloric acid to 100 parts water), and follow with an alkaline wash, and finally wash with water (try a test patch first to check for possible discoloration of the colored wall).

- Let the efflorescence run its course, use fogging equipment, and repeat if necessary.

- Contact the manufacturer of the cleaning products used for recommendations.

- Remember to try out test patches with these cleaning options first; these options may cause discoloration to the colored walls.

- Always remember to use the proper safety equipment when working with any chemical for cleaning efflorescence.

To summarize the information above, one needs to remember that efflorescence is a naturally occurring phenomenon in construction. The four factors described above — soluble salts, a physical force, moisture, and an opening — must be present for efflorescence to occur. There are items that can be controlled to help minimize the possibility of efflorescence and there are items we cannot control. There are ways to clean efflorescence, but it must be pointed out that just because it is cleaned off one time, that does not mean the efflorescence may not re-occur. Secondary blooms are possible.

One final note: Safety first when dealing with any chemical. Wear the proper safety equipment and review the manufacturer’s suggested applications and warnings.

For further information on efflorescence, please contact the National Ready Mixed Concrete Association (www.nrmca.org) or the Portland Cement Association (www.cement.org).

Silos: Not Just for Grain Anymore

Jerry L. Pozo, BMI Products

Silo, when I hear the term, my mind conjures up our great American Midwest or California’s Central Valley.

Rustic silo … those towering structures alongside a barn, on some back road through the American farmlands. They were influenced by grain storage pits of the “old world” and corn cellars of Native American. They were built of wood, fieldstone, tile, and brick, concrete and steel.

Today, silo has become a popular and common sight on urban jobsites, housing premixed and engineered products for the construction industry.

Europeans have used silos for dry construction products for over four decades. They dislike cluttered jobsites of pallets, sacks, bags, cartons, banding, jugs, and a huge pile of sand. There are more than 150,000 servicing the market from Sweden to Italy, and over 50,000 silos in Germany alone. The U.S. marketplace is just now recognizing and embracing this significant delivery system.

Since BMI’s entrance onto the U.S. Chicago scene in 1988, and the Milpitas, CA West Coast market in 1996, many projects have gained acceptance from this method of delivery. Of course, standard 90 lb bags or 2,500 lb super sacks are also available.

BMI plaster, mortar and stucco are factory-made blends of sands and binders. Our automated batch system controls the mixing process of our dry materials to ensure the consistency of our products. The final product is tested in our in-house laboratory for quality assurance and is then transported as a dry, premixed product to the construction sites. Testing is done by an independent laboratory to confirm our own test results.

Bulk dry material like BMI 690 Premixed and Engineered Plaster is held in a 27’ silo on an 8’ x 8’ pad. A continuous mixer, electrical and water source are hooked up, and with a control switch we can begin mixing the product, and pumping to the walls and ceilings.

Obviously, the most significant factor of premixed and engineered products is quality control/ assurance from start to finish. Also, it lessens the liability of the contractor from heavy lifting, bending, shoveling, and mixing errors. And finally it leaves jobsites clean, dry and uncluttered.

Sand is another issue. Many quarries are running dangerously low on quality sand, so suppliers are substituting river sand and pulverized rock. Much of this low quality material leads to excessive cracking.

One plaster expert has noted that with BMI products, many formulations of sand are possible. So, different formulations for different applications are possible. Our sand is clean and well-graded, without those things that lead to cement/sand reactions.

Many of our plastering subcontractor report that once they use the silo delivery system, they will never go back to sand piles and bag materials again.

Our subcontractors also report: increases in worker productivity, less injury, reduced material handling, safer material storage and no damage due to weather conditions.

By eliminating field mixing, sand piles, job debris, and uncontrolled water, this process is a real advance for the construction industry and fits nicely into LEED requirements to prevent jobsite mess, and prevent pollutants from entering the storm drain conveyance system.

Today, construction industry professionals feel that premixed products and silo delivery systems will be a “big part” of the future of stucco, and other product applications.

Survival in Today’s Challenging Times

Jamie Makuuchi, Director of Marketing, Parex USA and LaHabra Stucco

If you are still in business today, congratulations, you are a survivor! There is a high probability you will make it through to see better days. The good news is that the worst is behind us. The bad news is that it is not going to go up as fast as it fell and will take several years to fully recover. The dramatic decline our industry has experienced over the last 3-4 years have been unprecedented and devastating to many businesses that did not adjust their business enough or fast enough to mirror the new reality. The recent news talks about the risk of the “double dip” which, amusingly, implies that we are out of the first one. I guess our industry did not participate in the recovery and historically there is no “real” recovery without our industry improving. After one of the longest and greatest construction growth cycles in our history we all have to face the “new normal” and adjust our businesses accordingly or die.

LaHabra has been around since 1926 and has seen many cycles, including the Great Depression. California is one of the most cyclical construction economies in the nation, so we are veterans of change. Sacrifices and tough decisions were made, but we are committed to the industry and plan to be around another 85 years despite all the recent obstacles.

Although every major industry economist continues to decrease their forecast for 2011 and push the recovery out into the future more and more, the overall consensus for the residential sector is overwhelmingly positive for the United States and California. The pessimists are now forecasting home starts to increase in the 10%-15% range and the optimists are in the mid 30%-35%. The high growth rate sounds great, however, when based on historical low starts, the improved level remains depressed and nowhere near the number of starts reached in the go-go years of the mid-2000s. We fully expect the residential sector to improve, but not until the second or third trimester. Even if starts remain at historically low levels and below the natural demand in 2011, we will be relieved to see things move in the right direction.

There are many factors holding the residential sector from making a rapid recovery. Pent-up demand exists, but the fear of falling values keeps people on the side lines. A recent California homeowner poll was taken and only 25% see values increasing. Most sales in California remain distressed, keeping values down. Delinquencies and foreclosures have recently declined, but fear of the unknown shadow inventory hitting the market remains. Recent news on the possibility of eliminating or limiting the mortgage interest tax deduction does not help matters. If this happens, which is unlikely, it will have devastating consequences on values and ultimately lead to more foreclosures. Rising interest rates will have the same effect. Although rates will not remain at these historical low levels forever, the probability of significant increases in the near term are very low. The inventory of new homes is extremely low (easy to control), the problem is that they are not selling fast enough to create a major increase in demand. The inventory of re-sales (hard to control) is high and represents about 10 (about 2 times the norm) months of inventory based on the current rate of sales. This inventory also needs to flush through the system before a robust recover in new home building begins. Although regional data in California varies, the good news is that the values at the lower end of the market appear to be stabilizing and increasing in some areas. Unfortunately the higher-end is a bit more sensitive and values continue to decrease, although at a much slower rate. The first trimester of 2011 will be pivotal and likely determine the direction values will take this year.

The commercial building cycle is lagging the residential sector by a few years. Thankfully, the dramatic declines over the last 2 years are most likely behind us, but with the high vacancy rates in the private investment sector (office, industrial, retail etc.) we do not expect an increase in activity in 2011. We are anticipating 2011 to be flat to slight decrease relative to 2010.

If you are a survivor, consider yourself very fortunate. You have made the right moves already. Most of the tough decisions are probably behind you and you are in a much better competitive position to take advantage of the upswing when it happens.

Recycled Content – A Key “Green Product” Attribute

Ben Garcia, Expo Stucco Products

A 2009 report estimates the U.S. market for green building materials will exceed $80 billion by 2013. This is a predicted 7.2% annual increase over the next four years.1 Both “Green” construction managers and “Green” architects are expected to grow 20% more than professionals that are not considered “Green” professionals.2 In a recovering economy we are all looking for ways to take advantage of the growing portions of our industry. Offering “Green” alternatives to these professionals gives us an opportunity to join in this growing building trend.

The new CALGreen code mandates new building requirements for new residential and commercial construction in California as of January 1st 2011. Leadership in Energy and Environmental Design (LEED) is a leading-edge system for certifying the greenest performing buildings in the world. Both reference guides list recycled content as a green product attribute. The intent of CALGreen and LEED is to increase demand for building products that incorporate recycled content materials, thereby reducing impacts resulting from extraction and processing of virgin materials.

To do justice to the growing ecological demands, we should make it our business to develop ecologically enhanced plaster products. By including recycled content into our product mix, we can offer sustainable product solutions that will be able to contribute to LEED and CALGreen certification.

By offering both pre- and post-consumer recycled content in our products, we can attract the attention of architects, builders and developers committed to incorporating new and innovative products in this growing segment of our industry. As the CALGreen and LEED certification programs continue to gain relevance across North America so too will the demand for sustainable product solutions.

Sources:

1 ECOHOME Magazine, 2009

2 O*Line.com, 2009

Rock Science, Not Rocket Science

The following is a summary of the SMA meeting held at Carmeuse’s facility in San Juan Capistrano on aggregates in plaster.

Aggregates are important because they form 50-80% of most cement products, yet they are largely ignored in base coats and specifications. For instance, ask yourself how often ASTM standards are cited on homebuilder contracts. Do you request a certain quality aggregate for your scratch & brown?

There are several ASTM Standards that apply to aggregate:

• ASTM C-144: Standard for Masonry aggregate

– sometimes quoted in specifications

• ASTM C-897: Standard for Job-Mixed Cement Plasters

– commonly cited for base coats

– contains gradation specification

– also contains specs & test methods for “friable particles,” “lightweight particles,” organic impurities, and soundness

-exceptions for aggregate proven to work on similar jobs and special textures

• ASTM C-926 governs the Application of Portland Cement Plaster, as close to a 10 Commandments as there is in the stucco industry. It calls for C-897 sand, but has a weasel clause:

“unless failing sand has acceptable demonstrated performance record in similar construction and climate conditions”

The bottom line is that there is lots of flexibility in ASTM standards for selection of aggregates. The user can select aggregate most of the time. Common practice is to use washed plaster sand in scratch and brown coats, but this may or may not meet C-144 or C-897 standards. Since it is practically difficult to evaluate quality of aggregates, price and availability become the default keys to selecting aggregates.

In finish coat plasters, manufacturers typically use factory-made aggregates, such as are supplied by Gillibrand and Carmeuse in Southern California. Northern California producers commonly use Monterey silica sand or calcium carbonate from Chemical Lime, or truck in Southern California silica sand. These products are wet graded and rinsed for purity and accuracy of gradation, then dried for precise control of water in the final mix. Acrylic plasters commonly use rounder calcium carbonate, which are preferred for their light color.

The careful plastering contractor considers carefully the impurities in aggregates, as impurities in the #1 ingredient in your mix can cause big problems. Iron has caused dozens of houses to develop rust spots in the past. Clays absorb water from the mix, then shrink as they dry and cause cracking (although a little clay is necessary to help pumped material slip through the hose. The appearance of aggregates can also be important, as dark spots may peek through light colored finish coats and mar the appearance. And bond-breakers need to be avoided in aggregates as well.

The SE scale is an easy and fast way to test for impurities, even in the field. Add roughly equal parts sand and water, shake in bottle to put in suspension, and allow to settle 20 minutes. Measure what percentage of aggregate is sand and that gives you the SE. Our recent tests show that many local plaster sands test above 70 and 80 and should produce solid plaster. But hopefully the preceding discussion encourages the industry to care about the aggregate, beyond the cost and whether it pumps or not.

The SE scale is an easy and fast way to test for impurities, even in the field. Add roughly equal parts sand and water, shake in bottle to put in suspension, and allow to settle 20 minutes. Measure what percentage of aggregate is sand and that gives you the SE. Our recent tests show that many local plaster sands test above 70 and 80 and should produce solid plaster. But hopefully the preceding discussion encourages the industry to care about the aggregate, beyond the cost and whether it pumps or not.

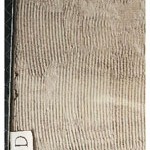

The sand on the left has a 93 SE rating. On the right is a 67 due to the higher silt content.

The lower SE you go, the more water you’’ll need, and the more shrinkage cracking, lower strength, less dense your wall will be. For instance, the photographs below show panels made with low and high SE ratings and the water demand to get the same slump.

4A: SE=49 & Plastic – 9 gallons water

4A: SE=49 & Plastic – 9 gallons water

4D: SE=86 & Plastic – 6.75 gallons water

4D: SE=86 & Plastic – 6.75 gallons water

The shape and hardness of the aggregate are also important. Sharp, angular sand sticks in plaster and floats out well without rolling; round aggregate rolls, pumps better, and gives worm texture. The Mohs scale is useful for thinking about the hardness of different aggregates: It is exponential, like the Richter scale for earthquakes, which means 3 is twice as hard as 2, and so on. So gypsum is a 2, Limestone/ Calcium Carbonate is a 3, and Silica sand is a 7. Silica is 10 times harder than limestone.

There are also some alternative aggregates to consider. Recycled concrete can be reused in new plaster. Glass beads (Poraver/Viceroy Ceramics) can also be used to give recycled content and lower weight and insulation/acoustic value. Perlite has long been used for weight reduction and added fire resistance. And foam beads are on the market that are lightweight, pumpable, and give higher insulation value.

At SMA, we believe that the people in the field every day are the best qualified to choose aggregates. They see what works and what doesn’t, and can consider far more in the equation than an ASTM standard or an SE rating. But the careful professional will be smart to pay close attention to the aggregates he uses and consider tighter specs on field-mixed aggregates to ensure good results. Factory-blended base coat products are also something to consider to reduce problems from stormwater runoff and tighter quality control. And alternative aggregates promise to help manufacturers improve their products, especially in the areas of sustainability, insulation, weight, and acoustics.

Volunteers Needed in Haiti to Aid Earthquake Relief

Shelter2Home, LLC is looking for volunteers (Traditional Stucco Applicators/Installers) to go to Haiti for a minimum of seven days to assist in the training of Haitian youth in the application of two and three coat stucco applications. Shelter2Home, a Virginia-based manufacturer is supplying the components for the construction of 50 new homes in the southern part of Haiti from funding by Cross International, a Florida-based non-profit. Volunteers will stay at the Pwoje Espwa Sud Guest House, which is located in Les Cayes, Haiti, and instruct students in various application on basic two-room homes built for families displaced by the January 12, 2010, earthquake.

For more information please contact Donald Stevens at +1-540-327-4424 or dstevens@shelter2home.com. Please reference “Haiti Stucco” when you call or email.